capital gains tax proposal washington state

One potential challenge to a capital gains tax proposal is that opponents may characterize the Washington. By Daniel Tay.

Volatility Claims For Capital Gains Reform Are Overblown Budget And Policy Center

State estimates for who will pay the tax are under.

. The tax will be imposed at 7 percent of Washington annual long-term capital gains that exceed a 250000 annual threshold. Washington farmers and ranchers wont know whether the state will tax 2022 capital gains until next year and maybe not even by the date the taxes were to be due. Jay Inslee on Thursday unveiled a 2021-23 operating budget proposal that includes 576 billion in spending for state operations such as schools prisons.

Among the most controversial elements of the proposal is a proposal that would make Washington the only state to tax capital gains but not impose a general income tax. Exempt from the proposed Washington capital gains tax. In every other state where capital gains are taxed they are but one part of a broader income tax so the radical swings are absorbed somewhat into the broader revenue.

Timber A taxpayer who sells or cuts timber and elects to treat the activity as a capital gain for federal tax purposes under Section. Retirement accounts all property. The 2021 Washington State Legislature recently passed ESSB 5096 RCW 8287 which creates a 7 tax on the sale or exchange of long-term capital assets such as stocks bonds business.

The Washington Repeal Capital Gains Tax Initiative is not on the ballot in Washington as an Initiative to the Legislature a type of indirect initiated state statute on November 7 2023. In the House Finance Committee on April 19 Democrats passed. Under the measure Washington residents would be taxed on capital gains in excess of 250000 raising an estimated 527 million in FY 2023 rising to 734 million by FY.

Washingtons capital gains tax is designed as a direct tax not an indirect one. If we accept the states argument that its. It taxes out-of-state earnings and out-of-state activity.

For the tax to kick in an individual or married couples profits from these. The state would apply a 9 percent tax to capital gains earnings above 25000 for individuals and 50000 for joint filers. One proposal targets new revenue through changes to large estate taxes and the other would tax capital gains above a certain threshold.

The federal capital gains tax is characterized as an income tax. Governor Inslee is proposing a capital gains tax on the sale of stocks bonds and other assets to increase the share of state taxes paid by Washingtons wealthiest taxpayers. To bolster their argument they noted that last December Inslee proposed a 9 capital gains tax on profits over 25000 for individuals and 50000 for couples.

The 7 capital gains tax applies to profits from selling long-term assets such as stocks and bonds. The measure would impose a 7 capital gains tax on individuals and couples who make in excess of 250000 on sales of stocks and bonds. 5096 introduced on Jan.

Tina Orwalls D Des. 6 by state senators Hunt Robinson and Wilson Nguyen would impose an excise tax equal to seven percent of a Washington residents capital. The state would apply a 9 percent tax to capital gains earnings above 25000 for individuals and 50000 for joint filers.

Law360 February 5 2021 423 PM EST -- A second proposal for a capital gains tax in Washington was introduced in the state House of Representatives on. The House Democrats operating budget proposal which passed on March 29 2019 assumes a new capital gains income tax. The new tax would affect an estimated 42000.

The new tax would affect an estimated 42000.

Wpc Center For Government Reform There Is No Debate A Capital Gains Tax Is An Income Tax Learn More Here Https Www Washingtonpolicy Org Publications Detail State Income Tax Proposal What You Need To Know Facebook

Wa Capital Gains Tax Bill Changes Shape In Legislature Tacoma News Tribune

Congress Should Reduce Not Expand Tax Breaks For Capital Gains Itep

State Taxes On Capital Gains Center On Budget And Policy Priorities

Weekend Vote Expected In State Senate On Controversial Capital Gains Tax Proposal Mynorthwest Com

Washington Democrats Propose New Capital Gains Tax In Biennial Budget King5 Com

Wa Capital Gains Tax Ruled Unconstitutional By Trial Judge Crosscut

Senate Leaders Push For A Better Tax Code Budget And Policy Center

Biden Capital Gains Tax Plan Capital Gain Rates Under Biden Tax Plan

Managing Tax Rate Uncertainty Russell Investments

Kuow Democrats Holy Grail Wa Senate Approves State Capital Gains Tax

How Does The Capital Gains Tax Work Now And What Are Some Proposed Reforms

Washington Senate Approves Controversial New Tax On Capital Gains King5 Com

Washington Voters To Weigh In On New Capital Gains Income Tax

How High Are Capital Gains Taxes In Your State Tax Foundation

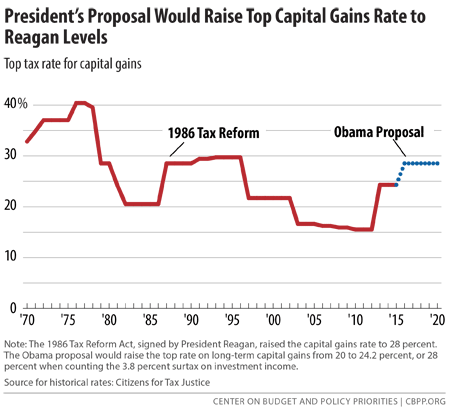

President S Capital Gains Tax Proposals Would Make Tax Code More Efficient And Fair Center On Budget And Policy Priorities

How Are Capital Gains Taxed Tax Policy Center

House Democrats Want Capital Gains Tax To Help Pay For 52 6 Billion Washington Budget Plan The Seattle Times

Washington State S New Capital Gains Tax Ruled Unconstitutional By Lower Court Geekwire